Losing a sale is always disappointing. And it stings extra when a prospect makes their way through most of the sales process before deciding to go with a competitor. But while the experience of that loss is mostly negative, it doesn’t have to be all bad. Every lead that chooses a competitor has the potential to teach you something valuable.

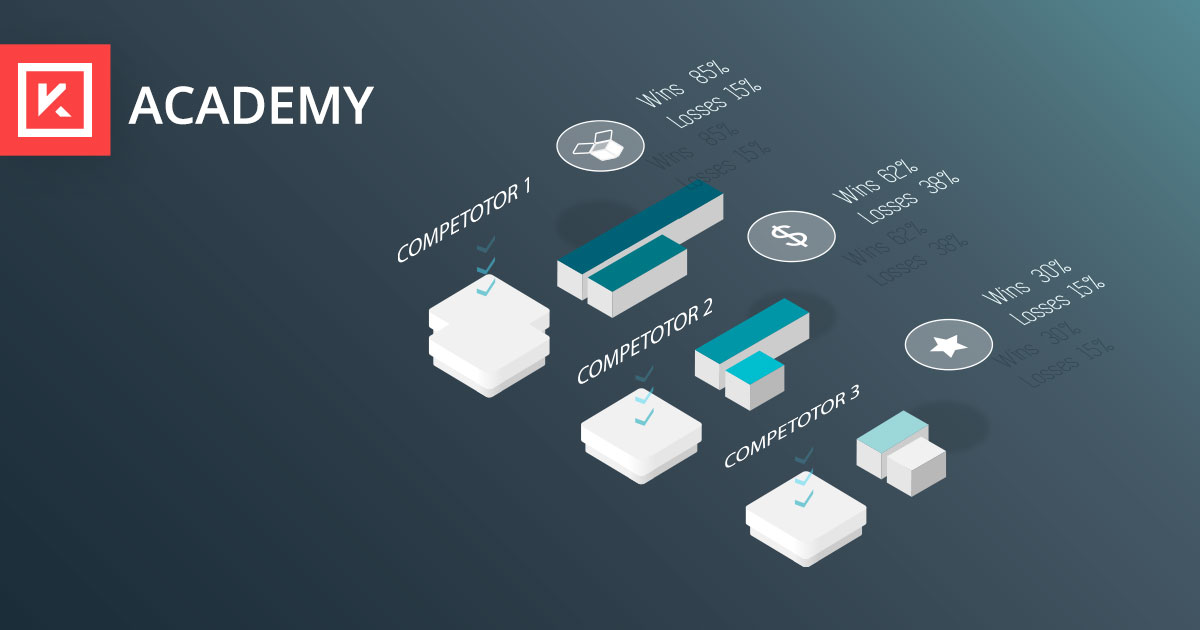

Investing in a win/loss analysis program can yield significant competitive insights that help you strengthen your overall business strategy. But any good win/loss program needs to start with measurement. You need to understand how often you’re losing sales and to who, before you can start the process of fully understanding why.

Why Understanding Win/Loss Rates is Important

Collecting accurate data on how often you win and lose sales is just one part of a good win/loss analysis. But it can get you on the right path toward gaining important data-backed insights.

1. You’ll learn who your biggest competitors really are.

Your main competitors may not be who you think. If your competitive analysis is focused on the biggest players in your space, but your prospects are frequently choosing a mid-sized company you haven’t been paying attention to, that’s crucial information you need. Collecting data on which products people choose when you lose a sale is the best way to figure out which competitors most deserve your attention.

2. You gain insights about what matters to your audience.

Learning which products you’re most frequently losing out to can provide some informed theories on what your audience values in their decision making. Are they consistently going for the lower-cost options? The user-friendly ones that require less training? Or products that offer a certain set of features yours currently lack? You’ll want to confirm your theories with win/loss interviews, but the data alone can point toward some clear trends that help you identify the priorities your audience has.

3. You can refine your idea of who your primary audience is.

Your marketing strategy is based on who you believe your audience to be. But what if you got it wrong and are focusing on a different target audience than the ones actually making purchasing decisions for your product? In that case, your marketing strategy could need a complete overhaul.

Your win/loss data is a starting point to understanding who’s deciding to buy, and who isn’t. You may find that the people purchasing don’t match the audience persona you created. If your target audience rarely converts, but a different audience frequently does, you’ll be better off reworking your marketing to focus on the people in the latter category.

How to Improve Win/Loss Measurement

While tech has an important role to play in measurement, it has to be matched with the right process and human habits to pay off. You can increase the accuracy of your win/loss tracking efforts by taking these four steps.

1. Configure your customer relationship software (CRM) to make tracking losses easy.

Your sales team is probably already using your CRM to log details about their interactions with prospects. If you give them a quick and easy way to track losses in the same tool they already use regularly, adding it to their process won’t add much work for them. To do this, add a custom field in the CRM for them to mark any time a sales interaction ends with a loss to a competitor.

2. Give sales a way to log the competitor that their prospect chose.

When sales does choose this option in the CRM, have it automatically let them choose from a list of all your known competitors. Knowing about the loss is useful, but knowing which competitor it went to is at least as important.

Do your best to keep this list up to date, so your sales team will consistently be able to find the right competitor. But also provide an “Other” option in case they hear from a client that opts for a new competitor that’s not on your radar yet. Create a workflow for any time Other is selected, so the new competitor will be added to the CRM and an alert will be triggered so relevant employees learn about the new player in your space.

3. Make sure they can also select the reason the prospect gives for their decision.

Also include a field where the sales team can select the reason the prospect gave for choosing another company. For the sake of data collection, having a main list of reasons they can choose from is useful here. It will make it easier for you to see quickly if a sizable proportion of your prospects are naming something specific, like finding a lower cost elsewhere or a key piece of functionality.

But also ensure they have a way to select “Other” here as well, and can fill in any details that don’t fit within the common list of reasons. You don’t want to lose out on data simply because it doesn’t match an easy narrative.

4. Train your sales team to log the data consistently.

Giving your salespeople a way to provide this information in the CRM with minimal effort is a big part of the battle. But making the option available doesn’t mean they’ll take it. Make sure they’re trained in what questions to ask prospects to collect this information, and what steps to take to log it.

Consider making the fields mandatory in your CRM, so the sales team is compelled to make a habit out of filling it in. But also emphasize to them why the data is important, and how it will help the development of key sales enablement materials that will make them more successful. If it looks like extra work, being asked to complete it will feel different than if you’re clear that they’ll be getting something out of it.

Analyze and Use What You Learn

Better measurement on its own won’t accomplish much. It needs to be one piece of a larger process that helps you first better understand your audience and the competitive landscape, then put what you learned to use in your product and marketing strategies.

Expand on what you learn from the data by setting up win/loss interviews to get more information from your prospects and customers. Couple the win/loss analytics with a larger competitive research program that helps you keep track of the strategies your competitors employ. And make changes to your product offerings and marketing strategies based on the insights you gain.

Without that last step, all the work you put into the research phase will be wasted. A good win/loss program must be the precursor to meaningful action for your business to see any benefits from it.