Playing the comparison game in our personal lives gets a bad rap. But in business, benchmarking performance is a key step towards setting realistic goals and creating informed strategies.

And, with Q4 upon us, there's no better time than now for some healthy comparison!

Let’s take this opportunity to evaluate sales performance and see what we can do to not just meet, but beat our expectations, finishing the year off with a flourish.

Some of the questions we sought to answer in our study include:

- What percentage of deals are competitive? How many of those do teams lose?

- How many sales teams are reaching their sales goals? What factors seem to improve their chances?

- Does the use of Battlecards correlate with a higher likelihood of a team reaching sales goals?

Stay tuned as we delve into key insights from our latest study. It may provide just the edge you need to finish the year off right.

The Current State of Competitive Sales

We asked 400+ U.S. sales leaders about the current state of competitive sales.

Here’s a sneak peek at what we learned:

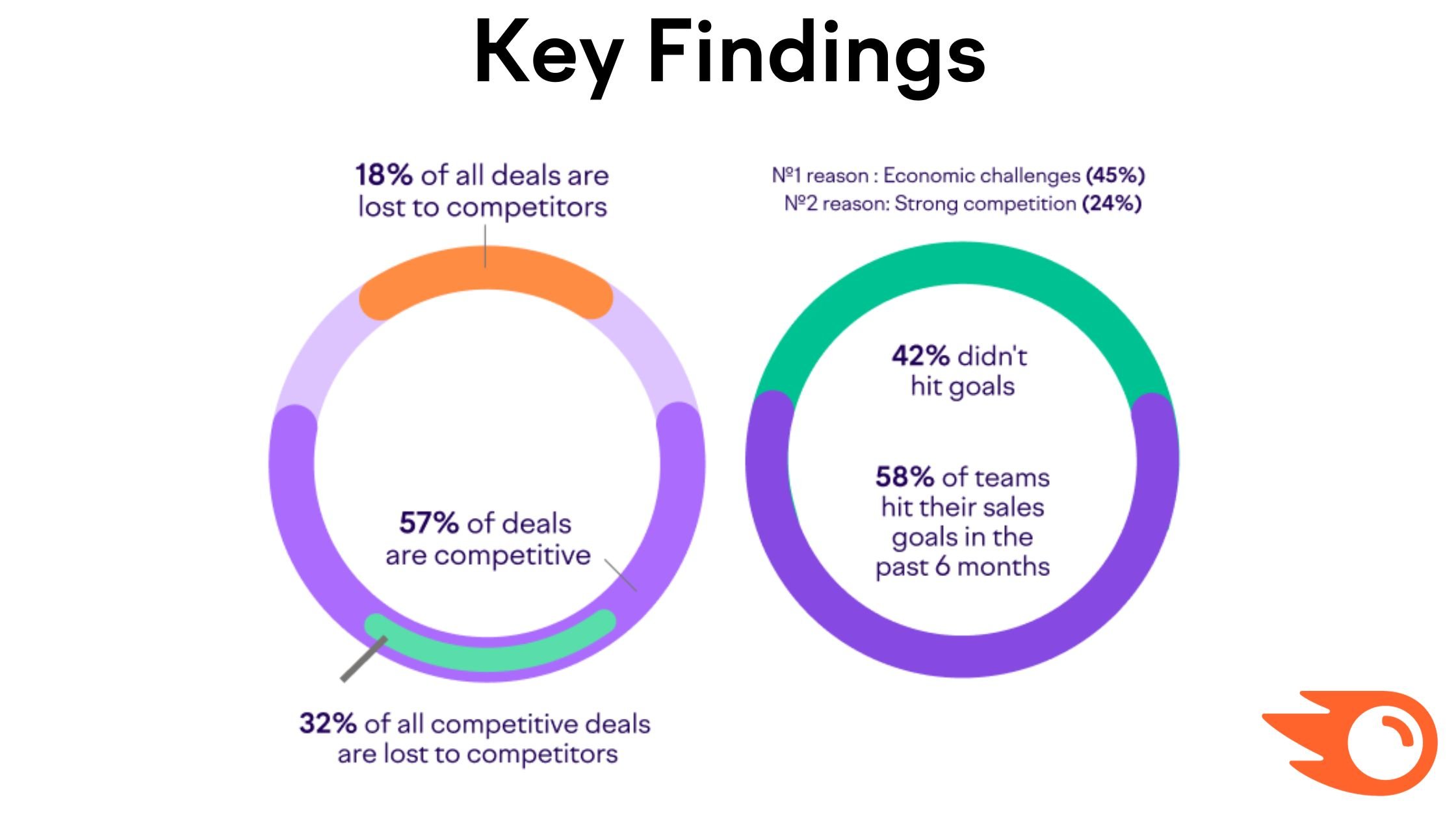

- 57% of deals are competitive

- 32% of all competitive deals are lost to competitors

Download the full report for more details.

This means that a stunning 18% of all deals are lost to competitors.

Additionally, 42% of respondents say their teams did NOT meet their sales goals over the past six months. 😨

We also examined whether company or sales team size, percentage of inbound leads v. outbound leads, industry, and use of sales assets would correlate to a better chance of closing competitive deals and ultimately, the likelihood that a company would reach their sales goals.

So, what activities correlate to a higher likelihood of hitting sales goals, and how can we use the findings to get ahead? Let’s get into some more highlights.

State of Competitive Sales Overall

We found that 57% of all deals are competitive, but with considerable variation by industry. Those in the financial industry report 70% of deals are competitive. Food and beverage companies report just 49%.

Not surprisingly, longer deal cycles and deals involving higher monthly recurring revenue (MRR) values experience a higher percentage of competitive deals. Interestingly, though, those with a higher percentage of competitive deals were no more likely to use sales enablement assets, such as Battlecards, than were those in less competitive fields.

“With data indicating that 1 in 3 competitive deals are being lost to the competition, it underscores the pivotal need in today’s business environment: the absolute imperative of robust competitive intelligence and sales enablement. Now, in 2023, sales teams more than ever, need to remain agile, informed, and stay ahead with the right competitive strategies”—Pere Codina, CEO, Kompyte

Winning and Losing Competitive Deals

With 32% of competitive deals lost, that means companies lose 18% of all deals to the competition. The length of the sales cycle and company size made little difference in this area. Variation by industry was minimal overall, but a small sample size of food & beverage industry respondents report just 24% of competitive deals lost.

“With the ever changing talent landscape and economic environment, companies' need for sales professionals to ramp faster and more efficiently will continue to be a priority. Understanding your prospects' challenges will remain paramount, but understanding your competitors' products and positioning will be a superpower to closing more deals.

Building competitive intelligence into the sales process is quickly becoming a need-to-have component of every successful organization.”—Mike Castellani, Vice President, Mid-Market and Enterprise Sales, Semrush

Hitting Sales Goals

Fifty-eight percent of respondents say their teams hit their sales goals over the past six months. We didn’t find any relationship between higher competition and likelihood of reaching sales goals, nor did company size or industry seem to make a difference. We did discover that the smallest sales teams (1-5 full time sales reps) were the least likely to reach goals, with only 45% reporting sales goals reached.

Use of sales enablement assets, though, is where a strong pattern emerged. The use of sales enablement assets is associated with a 32% relative increase in the likelihood of hitting sales goals.

“The competition in sales is fierce at the moment, especially with businesses struggling to find money and resources to invest in new ventures, so we have to rely on everything available to us to secure the deals.

Sales enablement assets are crucial to finding success in today's climate, and we see more and more sales teams investing in these assets and tools to funnel their growth.”—Michael Maximoff Co-Founder and Managing Partner, Belkins

We looked for variations across industries, and found that, while sample sizes are small, those in the retail/wholesale and food & beverage industry report an oversized boost when using sales assets and a notable decrease in the likelihood of hitting sales goals if they did not.

Why Teams Miss Sales Goals

Not surprisingly, the number one reason given for not reaching sales goals is “economic challenges,” with a full 45% of those who missed goals citing this as a factor. And while we can't do much to change the economy, we can all work to overcome the number two most-cited challenge, “strong competition.”

The reasons for missing sales goals were fairly consistent across companies of various sizes, percentage of competitive deals, and all industries, with one exception. In the financial industry, “unrealistic sales targets” took a strong number two position.

“Companies need to engage their sales teams fairly and adjust sales goals if they're going to roll back on hiring plans, resource investment, and digital transformation. You simply can't have a team doing more with less while the economy is slowing. The math doesn't work that way.“—Corey Donovan, President, Alta Technologies

Sales teams with 26-100 members report “product/service issues” and “pricing issues” as their second-most common reason for missing goals.

Sales Assets & Inbound Leads

Sixty-three percent of our respondents’ teams use sales assets at least half the time. And across all groups, an average of 34% of all leads are generated by inbound marketing vs. outbound.

Which teams are more likely to use sales assets? Not surprisingly, those selling annual contracts, those with larger deal sizes (except sectors with deal sizes over $100K), and those with larger sales teams.

The smallest sales teams (1-5 full-time representatives) are the least likely to use sales assets, reporting a 46% adoption rate. They’re also the team size associated with the lowest likelihood of hitting sales goals.

“Having 32% [relatively] better odds of hitting goals when you arm your team with helpful content and tools? Now that's an eye-opening stat.

It just confirms what we've seen with our own clients. Equipping our sellers with researched and tailored pitch decks, ROI calculators and one-sheeter templates, that's the extra edge when deals hang in the balance.

Sales needs dynamic assets that speak to each prospect's situation. Content that moves the needle.”—Jason Smit, CEO, Contentellect

What about the impact of generating more leads from inbound vs. outbound efforts? This didn’t seem to correlate to a team’s likelihood to reach sales goals.

Download the Full Report for More Stats and Discoveries

Check out the full report for a wide range of info on all competitive sales and to get a more detailed breakdown of our findings with shareable charts and takeaways.

Our Benchmark report gives sales leaders a source to evaluate their own performance and take advantage of practices associated with a greater likelihood of reaching their sales goals. How will you use it to improve yours?