Proactive analyst series: Tactics to increase social engagement

Find high impact social posts and list out a few proactive ideas and actions on what they can do to increase followers, engagement, or exploit a gap...

New to competitive intelligence? It's easy to get overwhelmed with all the available data sources, but we can help you figure out where to start.

.jpg)

Have you been tasked with helping your company get a competitive edge? Setting up a comprehensive competitive intelligence program is a crucial first step. But, it can be overwhelming.

You might be wondering:

In this blog post, we'll explore some of the best sources for competitive intelligence and how they help support various business goals and teams. You can then choose where to start based on what’s most important to you.

Competitive intelligence is the process of gathering information about your competition with the aim of improving your own business strategy. While competitive intelligence gathering may be the responsibility of a product marketing manager or competitive intelligence manager, the information gained is useful across all areas of the business.

The term “competitive intelligence” can also refer to the product of this research. As in, “We have competitive intelligence that indicates Company A may be planning a large expansion.”

Competitive intelligence enables a sales team to communicate the unique strengths of their products and services, overcome objections, and close more deals. It’s how you know about the alternatives your potential customers are researching and how to position yourself as the best choice.

Competitive intelligence allows marketing teams to plan and execute more effective launches, refine messaging and positioning, and learn what content is resonating with their potential customers. When you know how your competitors talk about themselves and how their audience responds, you can differentiate yourself while also learning from their experiences.

For product and executive teams, competitive intelligence can help plan roadmaps and avoid unpleasant surprises from your competition. When you know what your competitors offer (or can tell what they’re planning) and how their customers respond, it can help you decide whether you should build something similar, and if so, how to differentiate for a competitive advantage.

It’s also important to monitor pricing and promotions. While it’s almost never a good idea to compete solely on price, knowing a competitor’s pricing strategy can help you offer better value.

If you're trying to get buy in to support your competitive intelligence program, you might also enjoy this deep dive.

The answer is different for every business, and the answer is rarely “everything,” so where do you start? Let’s look at the available options, the goals and teams they support, and what might make it a priority for you.

As you’re considering each option, plan how you will make your findings available to those who need it. We recommend using sales Battlecards, reports, and alerts to keep everyone informed and up to date on the latest intel.

When you think of competitive intel, you probably think first about what you’ll learn by scanning competitors’ websites and news sites. Those are of course important sources of competitor intelligence. However, if you skip all offline sources, you’re missing out on data you’ll never find otherwise.

Sessions where your competitors are speaking or on panels can reveal a new product focus or business plan. If they have a booth, stop by and pick up a brochure and watch a demo or live presentation. Make sure not to hide who you are and don’t be afraid to have a friendly conversation. And remember to put these insights into your Battlecards when you get home.

Best for: Learning about new products and business focus. Supports roadmap planning.

During sales calls, your reps will naturally learn about competitor products. “We met with Company A and liked this feature, but found it was missing that feature,” or, “We liked your product, but needed this pricing and feature option that A offered.” Though they’re casual, off-hand remarks, the insights you can gather are priceless.

Because you don’t want these insights to vanish into thin air, you need a system in place to make sure your team is collecting and sharing insights somewhere that makes them available to everyone.

You could have a channel in your Slack or Teams channels to share them in real time, but someone should be responsible for adding them to sales playbooks/Battlecards or reports as appropriate.

Best for: Finding strengths, weaknesses, opportunities, and overcoming objections. Supports marketing and sales enablement efforts.

There are literally hundreds of millions of publicly-available data sources that can contain vital details about your competitors. If you’re scanning these manually, you’ll want to stick to a few. When you use automation like Kompyte, however, we look at all of them and then filter out the noise with advanced AI to serve up only what is relevant to you.

This is the most basic source and probably most important source for competitor information no matter your goals. Here are some key pages you should track and what you’ll find there:

Best for: Everything. Competitor websites should be high on your list of sources of competitive intelligence. Supports virtually every product and marketing strategy.

Monitoring your competitors' social media accounts can provide valuable insights that can help you improve your own social media strategy, but it can do so much more, providing:

Best for: Improving marketing strategy.

Keep an eye on sites like Glassdoor and Indeed to see employee reviews and new job postings. You’ll be looking for insights into their culture. You may also find ideas you can use to improve your own company culture. Learn which kinds of benefits you could offer to increase your chances of hiring top talent before the competition does. And look for a large number of job openings - this could indicate expansion plans.

Best for: Improving employer branding and talent acquisition, as well as spotting areas of potential competitor expansion. Supports the HR and executive teams.

Reading the reviews customers write for your competitors's products and services is absolutely critical to understanding how to sell your own product and even what to build next.

Why is that? Reviews will tell you exactly why people like your competitors’ products, why they dislike them, and even how/why they use them. Reading their own words puts you in a powerful position to articulate your own value proposition, overcome objections, and write messaging that resonates.

Some of the review sites Kompyte monitors include G2, Capterra, App stores, and Trustradius. Of course, any public review site can be monitored and you can be alerted when new reviews are posted.

Best for: Analyzing strengths and weaknesses as well as informing more powerful messaging that connects with your audience. Supports marketing and sales enablement.

Scan these sites to learn about company exits, acquisitions, investments, or other financial information. Some of the sites we specifically track include Google Finance and Crunchbase. Funding news can tell you about competitor growth strategies and help you find potential investors for your own company.

Crunchbase provides detailed information about revenue, employee count, and funding history which can help you identify areas where you might be falling behind. News of a new merger or acquisition can help you better understand the market and your competitors’ growth strategy.

Annual reports reveal much about business models, competitive advantages and prospects and plans for growth and investment in research and development. You may also pick up on their positioning, target audience, competitive landscape, and market share. Annual reports may also contain information on a company’s risks and challenges, regulatory pressures, and supply chain disruptions which could also become an issue for your business.

Best for: A bird’s-eye view of their performance with hints about upcoming plans. Especially since it only comes out once a year, be sure not to miss it. Supports leadership and product efforts.

Don’t miss it when your competitors are mentioned by PRNewswire. Product releases, funding, general news coverage - the first public mentions are often in the form of a press release.

Best for: Keeping up with major competitor developments. Supports product, sales, and marketing efforts.

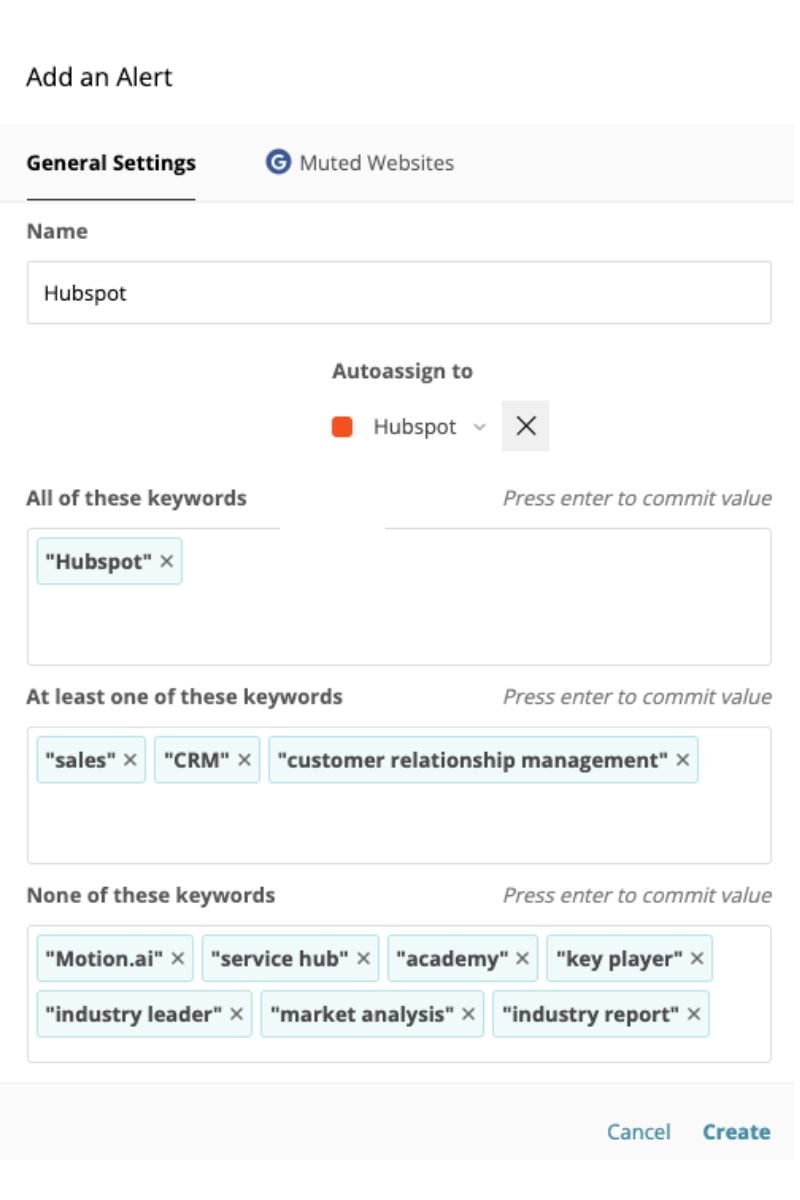

Never miss an important mention of your competitors and industry topics across the web. Whichever service you use, make sure you configure your filters carefully so you don’t end up inundated with irrelevant information.

Best for: Keeping up with industry news. Supports product, marketing and sales efforts.

Just like with dedicated review sites like G2 and Capterra, app store reviews can show you how users are talking about your competitors’ products and services. You can also review new app versions for feature additions and updates.

Best for: Uncovering user sentiment related to mobile apps. Supports product, marketing, and sales efforts.

What content and messaging is your competition paying to promote? How long did the ad campaign run (possibly indicating level of success)?

You can do an incognito search for your keywords to find the keywords they’re focusing on. You can also look at their Facebook ads by going to their page and viewing transparency options.

Best for: Seeing what is most important to your competitors and getting ideas for ads that might perform well. Supports marketing efforts.

What keywords do your competitors rank for organically? These insights can help you identify gaps in your own content strategy and find new opportunities to target valuable keywords. You may also gain a better understanding of the needs and interests of your shared target audience.

Best for: Planning SEO, content, and ads. Supports marketing efforts.

It can be tricky to figure out where to start when it comes to competitive intelligence sources, but knowing how each can help inform your product, sales, and/or marketing strategies makes it much easier to decide what you’ll track.

Another way to prioritize the data sources you'll track right away is to consider how easy they are to check on a regular basis. For example, checking your competitors’ homepage for new messaging once a week may be easier than looking up which Facebook ads they’ve started or stopped.

No matter how you prioritize, if you're trying to manually collect and analyze competitor insights, you'll probably end up with a nagging feeling that you're missing something important.

Fact is, it’s impossible to manually monitor and analyze all the important data sources that reveal key competitor insights. Which is why we recommend automating the gathering and curation of the insights as well as implementing a central source of truth so that everyone on the team has access to up-to-date intelligence.

We’d love to show you what that could look like for your business. Get a demo.

Find high impact social posts and list out a few proactive ideas and actions on what they can do to increase followers, engagement, or exploit a gap...

Find out how to use current CI data to create the right benchmark for the rest of 2020 and beyond.

Is your team losing deals that you know they should have won? Watch on-demand as Pere Codina, Kompyte CEO, addresses how you can stop wasting time...

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.