We're in this together, a message from our CEO

A word from our leaders. You're not alone and during these uncertain times, it's important now more than ever to remain connected.

Market research gives you customer and competitor insights to build brand awareness that scales and improves your funnel conversion rates.

Brand awareness is about more than just being known. It's about being the first to come to mind when someone needs what you offer. And in a way that makes that person smile.

And you're responsible for crafting the image and story that makes your prospects smile.

You've most likely used traditional brand awareness tactics and strategies. But times change, competitive landscapes change, and sometimes you just need a boost.

In this article, we'll talk about the importance of using market research and competitive intelligence to not only make your brand visible to your prospects but to make your brand instantly recognizable and unforgettable.

Chances are, you've seen a graphic like this representing a mere sampling of tools in your niche.

When you have strong brand awareness, your ideal customer looks at this chart, and your company's logo pops out from the mass of alternatives. You're an option they already know, and we're always looking for what's familiar. When that happens, you've successfully established a market presence in a competitive landscape.

You earned that distinction not because your logo is cute or trendy. Brand awareness comes when a prospect associates your logo instantly with your company's strong, trustworthy reputation.

With strong brand awareness, prospects more readily:

If you're looking to increase awareness of your brand, explore how to include market research in your next campaign.

When one of your responsibilities is to raise brand awareness, you work hard to optimize your social media content, top-of-the-funnel (TOFU) blog posts, and paid media. You A/B test, try out different formats and play with varying character counts. That's important.

These are often quick fixes. And, according to Merriam-Webster.com, quick fixes are "an expedient, usually temporary or inadequate solution to a problem."

Which often means more quick fixes in the near future. And more questions from your colleagues about why TOFU prospects aren't converting.

To prevent quick fixes and the associated pain, it's worth the extra time to conduct market research and competitive intelligence before you start your next brand awareness campaign.

This background work will uncover hidden issues and "aha!" insights that quick fixes won't solve. These insights will help you proactively build your campaigns to connect with your ideal customer before the campaigns go live.

Let's see this market-research-to-brand-awareness-boost journey in action.

Your market research starts at this point -- finding out who your prospective customers are, which includes analyzing your competitors' audiences.

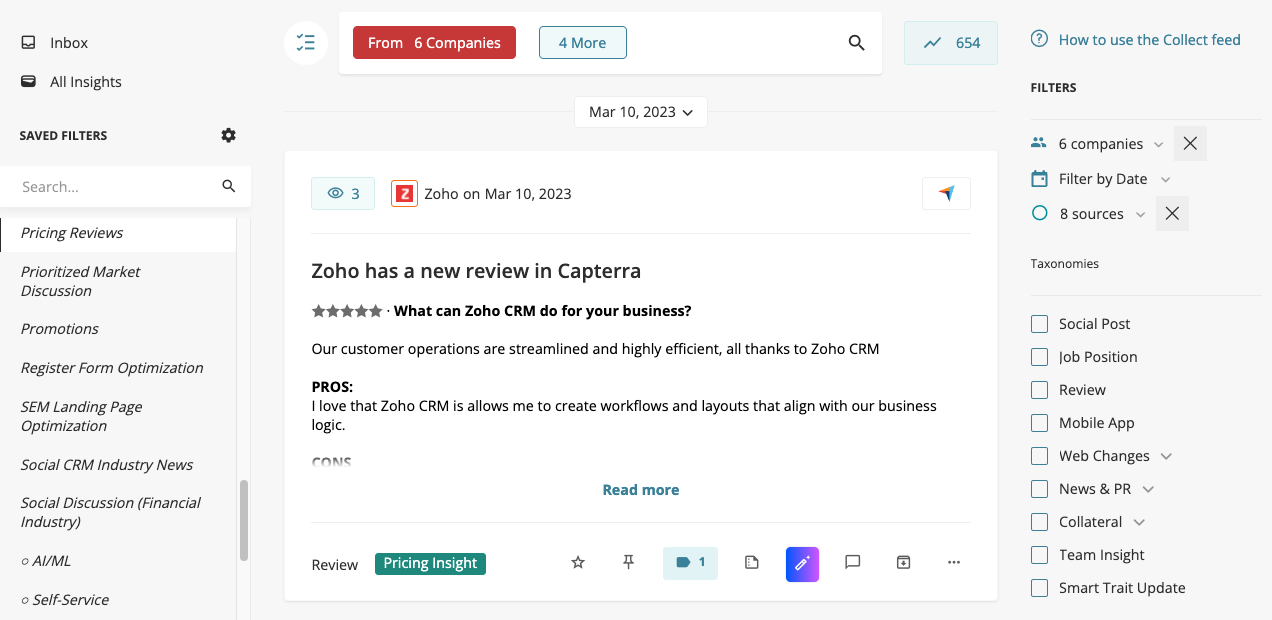

Start by tracking brand mentions and sentiment on social media, forums, and software review sites.

Kompyte captures mentions of review sites like Glassdoor, TrustRadius, Capterra, and G2, as well as social media platforms LinkedIn, Facebook, Twitter/X, YouTube, and Instagram.

Kompyte tracks over 500 million data sources daily, including user reviews for you and for your competitors.

While that passive feedback keeps rolling in, create and distribute surveys with your target audience to get a clear understanding of:

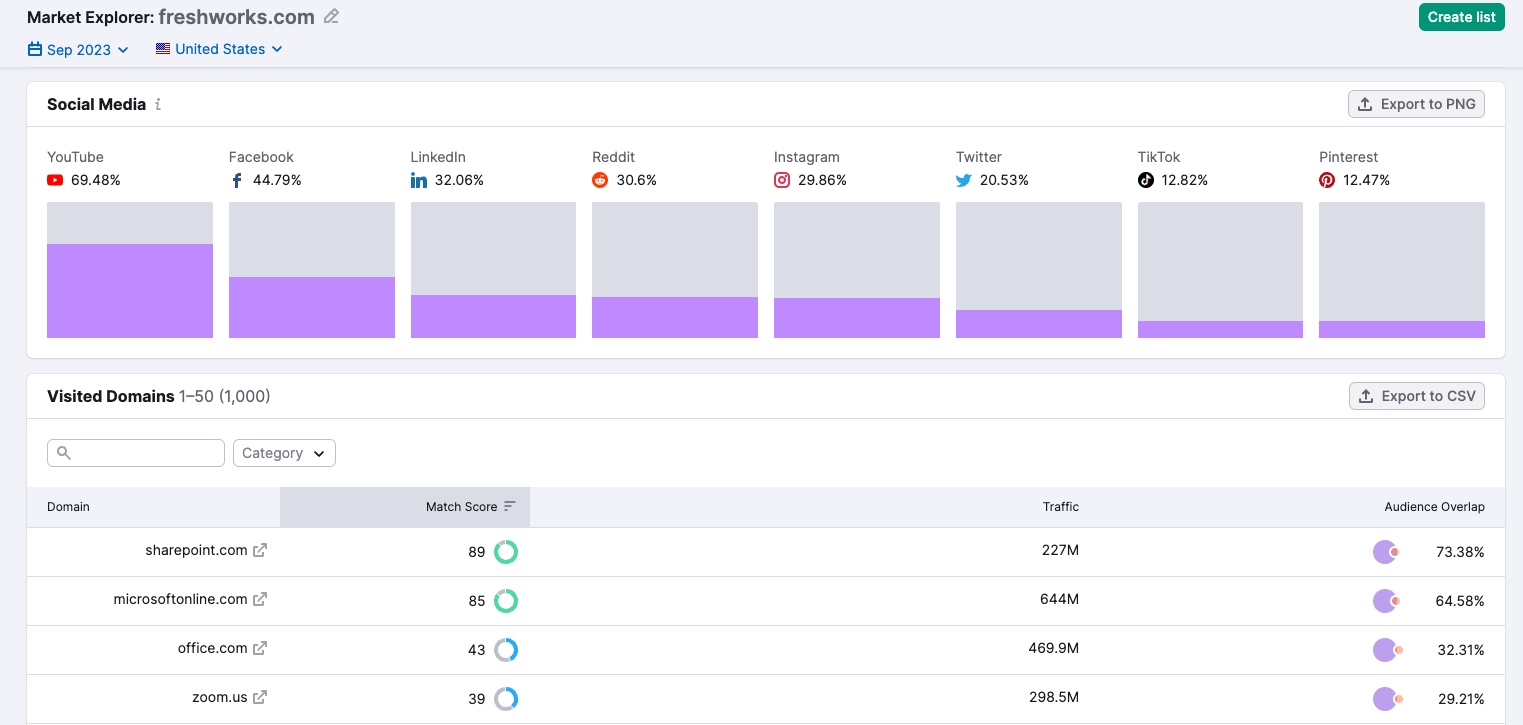

Where does your shared audience spend time online? Find out with Market Explorer from Semrush .Trends.

If you'd like a more in-depth look into your target audience, consider running focus groups or 1:1 interviews with a tool like UserInterviews.

Ellen O'Brien, Senior Director of Marketing at Lambent Spaces, gets the most out of using a variety of customer research activities, saying:

Starting with qualitative research like focus groups helps us hear the language our audience is speaking, We like to validate those smaller, in-depth takeaways with larger surveys, 200 similar titles across an industry, for example. We take all that data into a room and try to build brand messaging in a way that resonates with them for the right reasons - because it’s in the language they provided.

Once you've completed your market research -- or even while you wait for survey results to come back in -- use competitive intelligence to uncover:

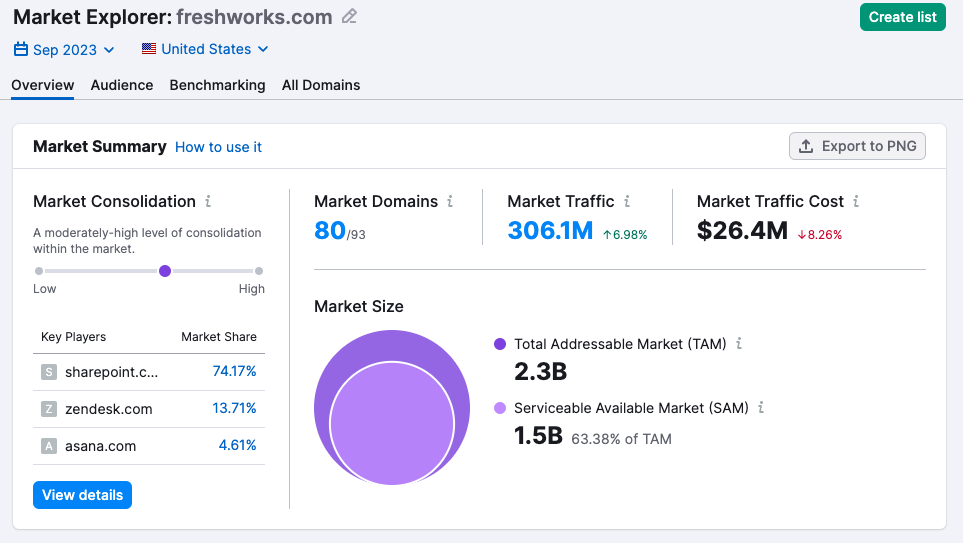

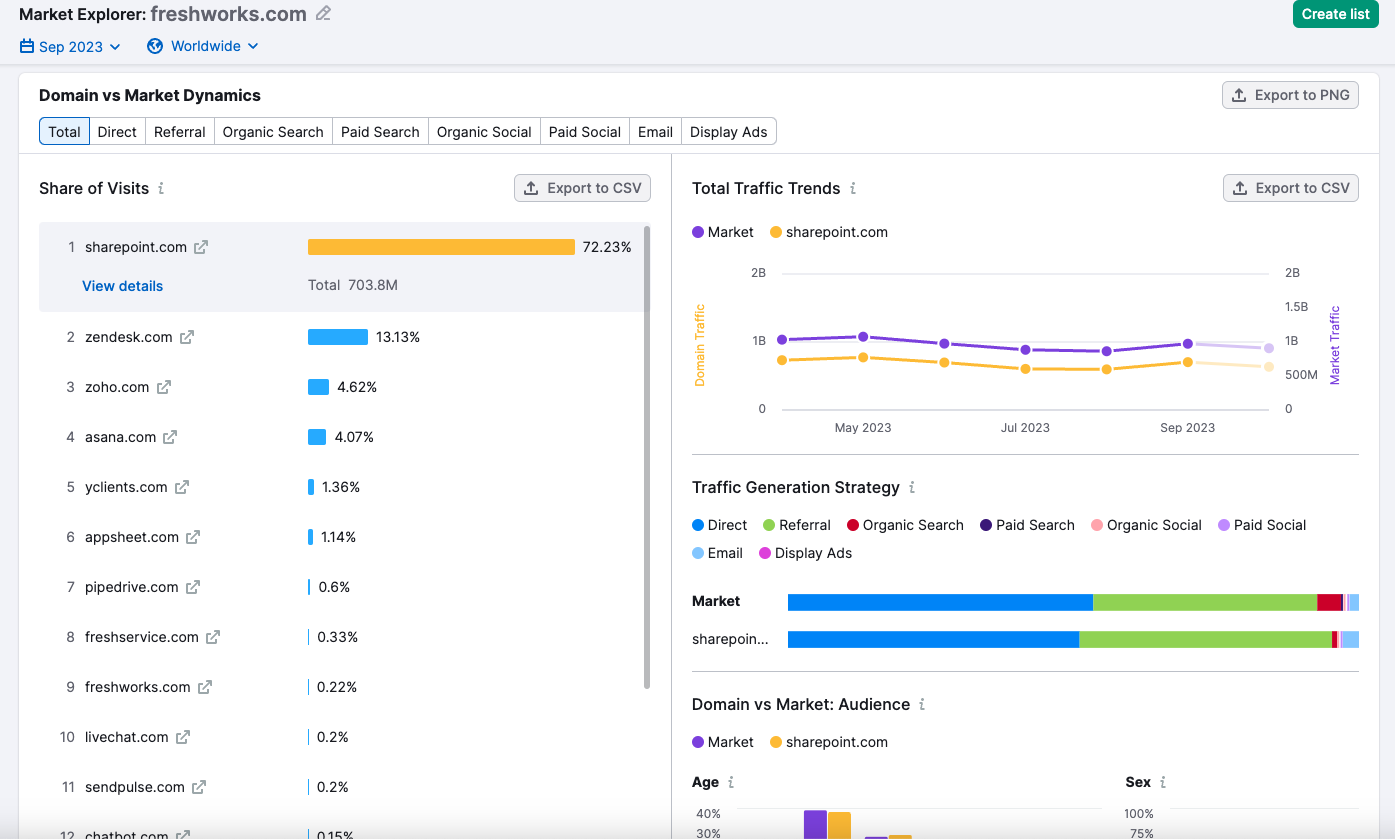

A competitive research platform like .Trends can give you instant access to the data you need here. Its Market Explorer tool serves up market share percentages for you and your competitors.

Here’s a pro research tip from Andy McCotter-Bicknell, Head of Competitive Intelligence at Apollo.io:

Don't limit your brand-building research to just your immediate competitors. Research brands that you look up to and leaders in adjacent categories. Find out what they’re doing well. Dig into their messaging, positioning, naming, email tone, and content strategy to get a true sense of how they execute their brand from top to bottom.

By better understanding your prospects and how you're perceived in the marketplace, your market research and competitive analysis will give you tons of data points and findings to:

With optimized value proposition and messaging, you can build your prospects' touchpoints to yield maximum results.

Here are ways to instantly apply your revised, market-informed value prop and messaging to build solid brand awareness across online marketing channels.

Market research can provide deep insights into what prospective customers expect when they visit a company's website or landing page for the first time. If you're looking to really boost website conversion, plan focus groups or target customer interviews and gather feedback on your home page. You can also use a platform like Wynter to get feedback fast.

And with those insights, you can tweak your website content so that it feels less like a corporate monologue and more like a strategic, personal dialogue. Now that you know what the prospect wants, needs, and expects from a solution like yours, you can develop content to proactively answer potential questions, address common pain points, and present solutions your target audience will love.

Any feedback you receive about the user experience on your site or competitors' sites will help you tweak the website to flow with user navigation preferences.

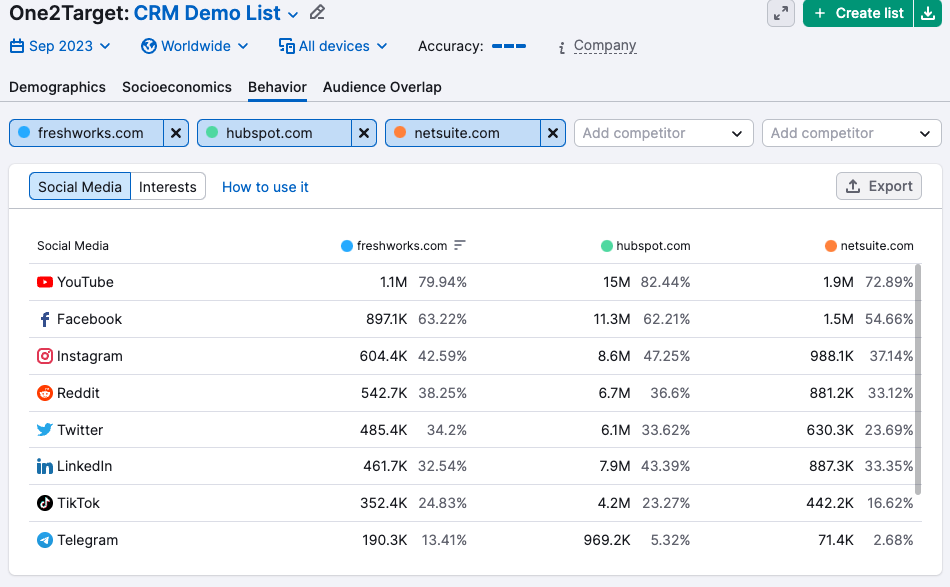

Every brand wants to get better at social media. But with market research and competitive intelligence in your pocket, you'll be ahead of most in trying to find ways to build brand awareness on social media.

First, your research should unearth where your target audience spends most of their time on social media. These revelations help you boost your brand awareness. Say you typically spend 10% of your time on LinkedIn, but through customer research, you learn that your audience (or your competitors' audience) actually spends 70% of their time on LinkedIn. That's a big sign to increase your level of brand awareness on LinkedIn.

See where your audience and your competitors' audiences spend their time online with Market Explorer from Semrush .Trends.

You should also look at where your competitors’ audiences spend their time. Platforms like Semrush .Trends Market Explorer make that simple.

You'll also learn what your audience expects from brands on each social platform. If you plan to spend more time on LinkedIn, you'll need to think more about how prospects expect you to post and respond on LinkedIn. Take these expectations to heart before you tweak your content calendar to build your brand on that platform.

Market research helps identify new platforms where your ideal customer interacts with brands and where competitors might not yet have a strong presence.

Did you learn that your prospects love to listen to branded podcasts -- but not necessarily podcasts hosted by brands in your space? If your company is not yet producing podcasts, this could be a great way to jump ahead of the competition and establish brand awareness with a new audience.

Has your paid media spend been primarily on Meta, but you learned through speaking with prospects that they love to click on witty YouTube ads from brands in your space? Here's an opportunity for you to build awareness and make the YouTube ad space tighter for your competitors.

Measuring the results of your new brand awareness campaigns is the most powerful way to understand the importance of collecting and applying market research and competitive intelligence.

But the best way to measure brand awareness of your new campaigns is to measure the old ones first.

Take a snapshot of your brand awareness campaigns' "before" state by marking important key performance indicators over the past six months. Start with metrics you typically measure in brand awareness, including:

Track your progress against your competitors with Market Explorer from Semrush .Trends.

Once your new, market-informed campaigns have been running for six months, compare these 0-to-6-month average metrics against your before-state numbers.

Want extra credit? Consider capturing the previous state of customer acquisition costs and customer lifetime value. At first glance, these indicators might not scream "brand awareness metrics." In time though, the ripple effect of improving your brand awareness can positively impact these numbers further down the funnel. Here, you can take averages of the past 6-12 months, depending on your industry, since it will likely take that long to see an impact on these metrics.

And remember the customer surveys, focus groups, and 1-on-1 interviews? Mark down their view of your brand and how it fits in among your competitors in a "before" stage. Then, in six to 12 months, conduct similar customer research and compare results.

Using market research and competitive intelligence to increase your brand awareness is not a one-and-done activity -- even when it returns great results on your campaigns!

Because the market and competitive landscape change daily in most markets, you'll have to create a routine to monitor the market regularly and build a feedback process to distribute and receive the latest marketplace news.

With Kompyte, sales and other teams can submit their findings from anywhere on the web with our Chrome extension. Depending on how you set up your Battlecards and Reports, those insights are automatically added.

Prospects' needs and perceptions also change fairly often. Ensure you set aside time and money surveys, focus groups, and 1-on-1 interviews in your annual planning.

With the latest marketplace information, you'll be able to easily make adjustments to your brand awareness campaigns and optimize results.

Growing brand awareness is a strategic process that should include ongoing market research and competitive intelligence. By leveraging in-depth market insights, your team can create meaningful prospect connections and set the stage for your brand's long-term success.

A word from our leaders. You're not alone and during these uncertain times, it's important now more than ever to remain connected.

10 Inspiring Quotes On Competition In Business

If you’re not a brand, you’re a commodity.” Robert Kiyosaki - author of “Rich Dad, Poor Dad

Be the first to know about new B2B SaaS Marketing insights to build or refine your marketing function with the tools and knowledge of today’s industry.